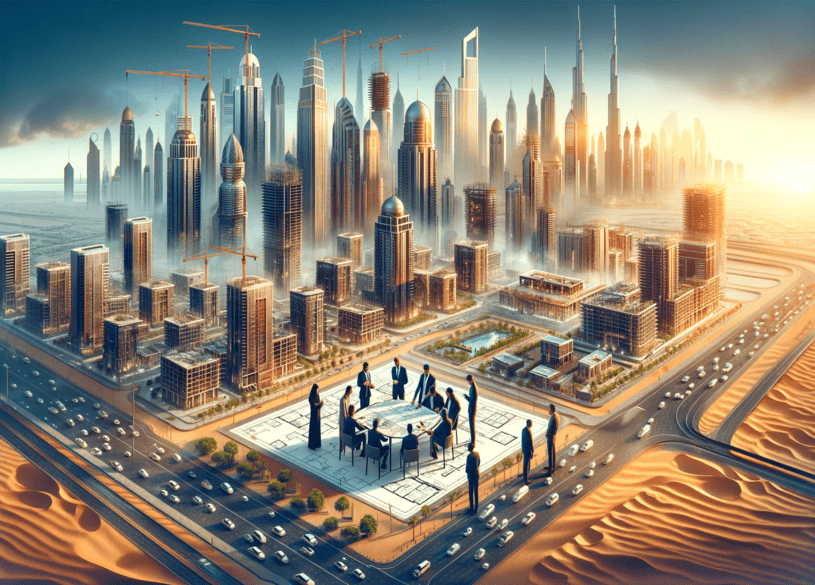

Dubai has emerged as a premier destination for real estate investment, drawing attention from both local and international investors. Among the various investment options available, off-plan properties have become increasingly popular due to their unique advantages and promising returns. If you’re contemplating diving into Dubai’s real estate market, here are five compelling reasons why investing in off-plan properties is a wise choice.

Cost-Effectiveness and Flexible Payment Options

Investing in off-plan properties presents a cost-effective opportunity compared to purchasing completed projects. These properties, still in the pre-construction phase, typically come with lower price tags and attractive payment plans. Developers often offer flexible payment schemes, such as staggered payments or post-handover plans, making it easier for investors to manage their finances while securing valuable assets.

Potential for Capital Growth

The dynamic economy of the UAE sets the stage for significant capital appreciation in real estate investments. Off-plan properties tend to appreciate in value as they near completion, allowing investors to capitalize on the price difference between the pre-construction phase and the final market value. The growth potential is further fueled by the development of surrounding areas, which can substantially enhance the property’s market appeal and value.

Promising Rental Returns

The constant influx of expatriates to Dubai creates a high demand for rental properties, making rental income a lucrative aspect of off-plan property investment. Modern amenities and innovative designs often associated with off-plan properties attract tenants, ensuring a steady stream of rental returns for investors. Whether it’s apartments or villas, off-plan properties offer appealing rental prospects in Dubai’s thriving real estate market.

Robust Buyer Protection Laws

Investing in off-plan properties comes with inherent risks, but Dubai’s stringent regulatory framework provides comprehensive protection for buyers. Regulatory bodies like the Real Estate Regulatory Authority (RERA) and the Dubai Land Department (DLD) enforce strict guidelines to safeguard investors’ interests. Measures such as escrow account requirements and financial guarantees from developers instill confidence in the reliability and security of off-plan investments.

Diverse Range of Projects

Dubai boasts a diverse portfolio of off-plan projects catering to various preferences and lifestyles. From vibrant urban developments like Downtown Dubai to serene communities in emerging areas like The Valley and Dubai Hills Estate, investors have a plethora of options to explore. Each project offers its unique advantages, allowing investors to tailor their investment strategy to align with their goals and preferences.

Key Considerations Before Investing in Off-Plan Properties in Dubai

While investing in off-plan properties in Dubai offers numerous benefits, it’s essential for investors to approach the market with caution and awareness. Here are some critical considerations to keep in mind before making a decision:

Anticipate Potential Delays

Delays in project completion are common in the off-plan property market, posing challenges for investors, especially those planning to relocate or rent out the property immediately. Having contingency plans in place can mitigate the impact of such delays and ensure a smoother investment experience.

Set Realistic Expectations

When investing in off-plan properties, it’s crucial to manage expectations regarding the final outcome of the project. While promotional materials may showcase enticing features, variations in construction materials or design changes can affect the end result. Thorough research on developers’ track records and completed projects can provide valuable insights into the quality and reliability of the investment.

Be Aware of Market Volatility

The property market is subject to fluctuations, and investors must stay vigilant to market dynamics that could impact their investments. While off-plan properties offer the potential for high returns, market volatility can affect the value and demand for these investments. Keeping abreast of market trends and seeking professional advice can help investors make informed decisions and mitigate risks.

Conclusion

Investing in off-plan properties in Dubai presents a lucrative opportunity for investors seeking to capitalize on the city’s thriving real estate market. With cost-effective pricing, potential for capital appreciation, promising rental returns, robust buyer protection laws, and a diverse range of projects to choose from, off-plan investments offer a compelling proposition for both seasoned investors and first-time buyers. However, it’s essential to approach the market with caution, considering factors such as potential delays, realistic expectations, and market volatility. By staying informed and conducting thorough due diligence, investors can navigate the off-plan property market in Dubai with confidence and maximize their investment potential. Contact Us!